Is the Blended Retirement Lump Sum Fair?

In approximately ten years when the first wave of active duty personnel who opt into the new Blended Retirement System (BRS) start to retire, they may be asked: Do you want your full immediate annuity? Or do you prefer to get part of its value in a discounted lump sum at retirement in return for forfeiting either one half or one quarter of your retired pay until age 67, when you would see full annuities restored?

But if the Department of Defense (DoD) Board of Actuaries has its way, that won’t happen. The board has called the system inappropriate and has asked Congress to rescind the choice.

While lump-sum buyouts of pension obligations are common in the corporate world, the formula Congress has prescribed for setting military lump sums is not. The amounts offered will be too large to ignore for many retirees seeking to get out of debt, buy a home or start a business. But the lump sum choice also will lower the lifetime value of retirement packages significantly. This is a huge financial consideration.

The formula to be used for setting an aggregate personal discount rate for enlisted and officer retirees will combine an inflation-adjusted, 7-year average of the Department of Treasury High-Quality Market (HQM) Corporate Bond Spot Rate Yield Curve at a 23-year maturity with an adjustment factor of 4.28 percentage points. That last factor seeks to capture some of what past studies have learned about military personal discount rates.

This is a formula that is very difficult to understand for most of us.

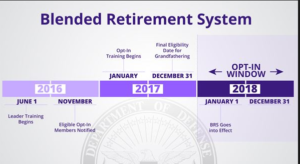

The BLS plan enacted for new entrants starting in 2018, with an opt-in option for current members having fewer than twelve years of service by then, is the vision of the Military Compensation and Retirement Modernization Commission.

The Department of Defense asked Congress not to include the commission’s lump sum scheme in the final BRS plan. The House initially agreed while shaping its retirement reform legislation. Senators, however, favored the feature to hold down costs. So, the final compromise that became law allows lump sum offerings for accepting a 50 percent and a 25 percent cut in retired pay until age 67.

The board predicted accurately that the department would settle on “some type of aggregate personnel discount rate” for both enlisted and officers. But it also predicted the resulting lump sums could produce behaviors by retirees significantly different than what the commission or Congress had projected. It also could feed a belief the lump sums are designed “to take advantage of our service members.”

When considering these options that significantly impact your financial future, obtain all the information and make informed decisions.

Tell us if you think this is fair by emailing us at: info@localhost